Iowa

Iowa Payroll and HR Resources

Welcome to the Iowa resource page for Workforce PayHub Payroll and HR. This centralized hub is designed to provide you with critical state-specific information and direct links to important forms related to payroll and human resources.

This page is regularly updated to reflect the latest information and regulations. However, always consult with the respective state departments or legal counsel for official advice.

Key State Payroll and HR Information:

-

State Minimum Wage (as of 2024): $7.25 per hour, which is the federal minimum wage rate.

-

Overtime Rules: In Iowa, overtime is paid at 1.5 times the regular rate for hours worked over 40 in a workweek

-

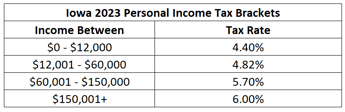

State Income Tax Rate:

-

Unemployment Insurance Rate: rates range from 0% to 7% in 2023. The unemployment taxable wage base increased from $34,800 to $36,100.

Essential Iowa Forms & Links:

-

Iowa Income Tax Withholding Form (IA-W4): Employers in Iowa use the IA-W4 form to withhold the correct state income tax from employee wages. You can find this form on the Iowa Department of Revenue website or through your payroll provider.

-

Iowa New Hire Reporting Form: Employers in Iowa are required to report newly hired or rehired employees within 15 days of their hire date.

-

Iowa Unemployment Insurance Reporting Form: Employers in Iowa who are contributing to the state's unemployment insurance fund must report their wages and pay unemployment taxes.

-

Labor Law Posters:

- Employers in Iowa are required to post various labor law posters in a prominent location for their employees. Some of the key posters include:

- Iowa Minimum Wage Poster

- Workers' Compensation Notice

- Iowa Unemployment Insurance Notice

- Occupational Safety and Health Administration (OSHA) posters, if applicable

- Equal Employment Opportunity (EEO) posters, if applicable

You can obtain these posters from the Iowa Division of Labor's Labor Services Division or through reputable poster compliance companies.

These requirements are in addition to federal posting requirements.

- Employers in Iowa are required to post various labor law posters in a prominent location for their employees. Some of the key posters include:

Useful Iowa Labor and HR Resources:

- Iowa Workforce Development provides a wide range of services and resources for both employers and job seekers. You can find information on unemployment insurance, labor market data, workforce training, and more.

- IDOL oversees labor laws and regulations in Iowa. Employers and employees can access information on wage and hour laws, workers' compensation, and workplace safety.

- This division provides information on workers' compensation laws and processes in Iowa. Employers and employees can access forms and resources related to workers' compensation claims.

- This division provides information on labor laws, wage and hour regulations, and workplace safety. Employers can also access information on labor law posters.